By Dr Minh Alexander, NHS whistleblower and former consultant psychiatrist 12 March 2019

|

Summary: HM Treasury is responsible for scrutinising special, non-contractual severance payments and related gags in the public sector. Parliament asked the Treasury in 2014 to track the pattern of severance payments across the wider public sector. However, the government has resisted this. It gave the job to individual government Departments, which have a conflict of interest in reporting such data. A most cursory inspection of Department of Health and Social Care data on severance payments and minimal cross checking against other sources raises questions about its accuracy. The Treasury was asked if it kept its own data on special payments and gags, but in an FOI reply the Treasury frostily maintained that it does not track the settlement agreements and gags that it signs off. Plus ça change.

|

HM Treasury talks a tough game. The relevant Treasury guidance ‘Managing Public Money’ makes robust statements about the use of special severance payments. For example:

“It is good practice to consider routinely whether particular cases reveal concerns about the soundness of the control systems”

“Any proposal to keep a special payment confidential must be justified especially carefully since confidentiality could appear to mask underhand dealing.”

“Departments should not treat special severance as a soft option, eg to avoid management action, disciplinary processes, unwelcome publicity or reputational damage.”

“The Treasury adopts a sceptical approach to proposals for special severance settlements, in particular:

- precedents from other parts of the public sector may not be a reliable guide in any given case;

- legal advice that a particular severance payment appears to offer good value for the employer may not be conclusive since such advice may not take account of the wider public interest;

- even if the cost of defeating an apparently frivolous or vexatious appeal will exceed the likely cost of that particular settlement to the employer, it may still be desirable to take the case to formal proceeding;

- winning such cases demonstrates that the government does not reward failure and should enhance the employer’s reputation for prudent use of public funds.”

In reality, the Treasury has nodded by all sorts, as reported by the National Audit Office in two linked reports:

Confidentiality clauses and special severance payments June 2013

Confidentiality clauses and special severance payments – follow up October 2013

In its follow up October 2013 report, NAO commented:

“The Treasury has approved some severance payments, where business cases refer to failure or inappropriate behaviour. The Treasury’s guidance states that payments that reward failure, inappropriate behaviour or dishonesty should not be approved. Yet we found business cases referring to elements of alleged gross misconduct or staff harassment. These alleged behaviours do not meet the standards of the Civil Service Code. Severance terms were approved because legal advice set out that the individual would be likely to win an award in an employment tribunal and settlements would probably be cheaper and quicker and therefore a better use of resources. This may be valid for individual cases, but it may not be true for the wider public sector. For example, alternative options (such as performance management or employment tribunals) may act as a deterrent or set a precedent to reduce future claims and costs”

In a report of January 2014, the Public Accounts Committee advised that public sector settlement agreements should be tracked, because unusually high numbers of agreements “might provide an early warning of management failure”.

The Committee recommended:

“The Cabinet Office guidance should set out how lessons are going to be learnt across government to prevent reoccurrence where a failure of process has occurred within an organisation.

The Treasury should be responsible for monitoring activity across the wider public sector, and for defining what action will be taken where significant patterns or trends are identified.”

The Government broadly agreed to the above, but it rejected the proposed Treasury surveillance of pay offs and gagging. Instead, it arranged for individual government departments to monitor settlement agreements and severance payments in the wider public sector.

This seemed odd when the Treasury is the central handler and was better placed to maintain an overview. But that would assume clarity is desired.

Taking the Department of Health and Social Care (DHSC) as an example, the DHSC gives only broad figures in its annual reports for special exit packages across its departmental group (which includes central NHS bodies, CCGs and NHS trusts and NHS foundation trusts).

Across the DHSC departmental group, special severance payments have been reported as follows:

| YEAR | ‘Number of departures where special payments have been made’

|

| 2014/15 | 51 payments, £2,025,270

|

| 2015/16 |

41 payments, £1,222,998

|

| 2016/17 | 28 payments, £ 479,778 |

| 2017/18 | 30 payments, £ 653,735

|

These figures seem low. It is already known that there are hundreds of settlement agreements and gags applied by the NHS every year. For example, the notorious Liverpool Community Health NHS Trust alone accounted for 157 super-gags between 2011 and 2016.

A recent BBC Four FOI reportedly found that £70million had been paid to NHS staff through settlement agreements over a five year period.

Not all settlements will be special severance payments that require Treasury approval. Some will relate to voluntary resignation schemes. But even so, the Department of Health and Social Care’s figures for special severance payments are likely to be wrong, and an underestimate.

NHS Improvement’s consolidated 2017/18 accounts for all NHS providers (NHS foundation trusts and non-foundation trusts) shows equally low figures.

NHSI admitted to only 18 special, non-contractual payments by NHS service providers, of unspecified value:

Public bodies are supposed to report special severance payments in their annual reports. A quick check of NHS bodies’ 2017/18 annual reports reveals that the Department of Health and Social Care’s special payments data cannot be fully cross checked against the data in these annual reports. The annual reports give data on exit packages in variable format, a few do not mention exit packages at all and many bodies do not specify how many special severance payments were made.

But here are some of the listed special, non-contractual severance payments in 2017/18:

Royal Wolverhampton NHS Trust – one special payment of £5,000

Cambridgeshire and Peterborough NHS Foundation trust – one special payment of £38,000

Cambridge University Hospitals NHS Foundation Trust – one special payment of £13,000

James Paget University Hospital NHS Foundation Trust – one special payment of £48,000

Essex Partnership University NHS Foundation Trust –one special payment of £10,000

Queen Elizabeth Hospital, King’s Lynn, NHS Foundation Trust – 11 special payments of £50,000 total value

University Hospital Bristol NHS Foundation Trust – three special payments, of £13,000 total value

Nottinghamshire Healthcare NHS Foundation Trust – One special payment of £12,000

Oxford University Hospitals NHS Foundation Trust – One special payment of £15,000

So my non-comprehensive flick through NHS trust annual reports has already produced a total of 21 special payments for 2017/18, which exceeds the number of 18 admitted to by NHS Improvement. This raises questions about the validity of published government data.

The Department of Health will be asked to clarify how it comes by its data on special severance payments, but it is likely that it depends on reporting by bodies such as NHS Improvement.

To see if the vagaries of Departmental reporting could be circumvented, the Treasury was asked what data it had collated on public sector settlement agreements, severance payments and confidentiality clauses since 2013, and to disclose any such data if it was held. The Treasury was also asked if it had reviewed its approval of settlement agreements and severance payments.

The Treasury’s initial response was to claim that it would exceed the cost limits under FOIA to answer these questions.

A request was re-submitted, focusing only what data was held by the Treasury.

The Treasury has responded claiming that it has no policy of keeping data on the settlement agreements and gags that it signs off:

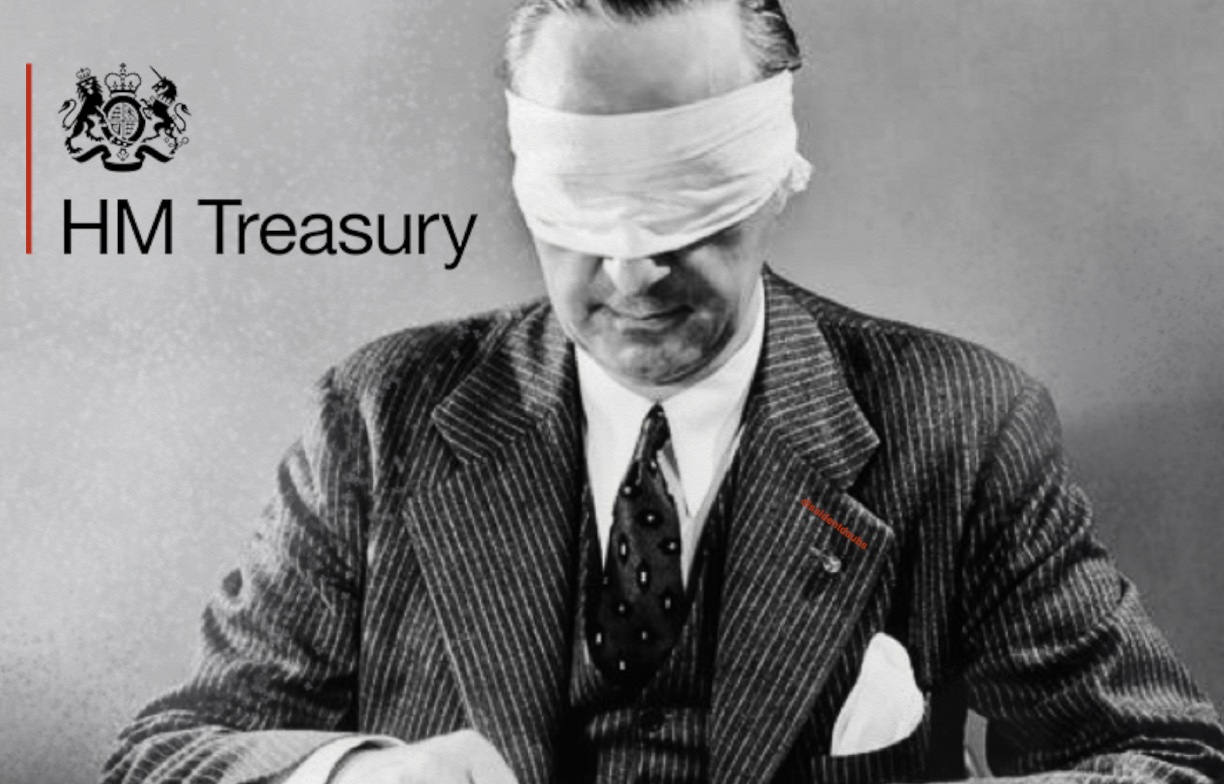

So there we have it, dodgy Departmental data and a refusenik, central controller who signs off gags blindfold.

Whatever propaganda gushes forth from the government and the National Guardian about commitment to greater transparency, you can be confident that the real secrets will remain locked down.

We need overhaul of UK whistleblowing law.

RELATED ITEMS

Gags still stop whistleblowers speaking out: Government claims about new safeguards are hollow

NHS Gagging. How CQC sits on its hands

Replacing the Public Interest Disclosure Act (PIDA)

It seems to me that the only government office that doesn’t resemble the Augean stables and requires a Herculean effort to clean out, is the NAO. I imagine its days are numbered.

Thank you, Dr. A, for your sterling work. Unpleasant though it may be, it is vital.

LikeLiked by 1 person

Perhaps I could add a link to a short article that is most welcome.

https://www.thetimes.co.uk/article/secrecy-and-spin-is-a-blight-on-politics-8bjgd387z

LikeLike

VITAL MINH Thank you.

LikeLiked by 1 person

Why would HM Treasury say that locating records of settlement agreement would exceed cost limits when they knew all the time that they held no records. Curiouser and curiouser.

LikeLike